Solar Sales: When a Big Bet Goes Awry

In spring 2023 SumoQuote* was 2 months away from launching our solar sales product extension. The solar industry was in decline and the extension we had worked so hard on lacked additional user validation. Our mitigation tactic, a carefully planned closed beta, had gone up in flames. Through a series of pivots and recovery efforts, we were able to course correct and launch on time.

SumoQuote Solar generated $1.5M in additional revenue for our customers in the first few months.

Project Summary

SumoQuote is a Saas sales enablement (quoting) tool for roofing contractors. In summer 2022, we began designing and developing a solar sales product extension.

Roles: Product Manager, Product Design Lead Team Size: 6+ (Design, QA, development) Timeline: 6 months total

A Big Bet With Big Challenges

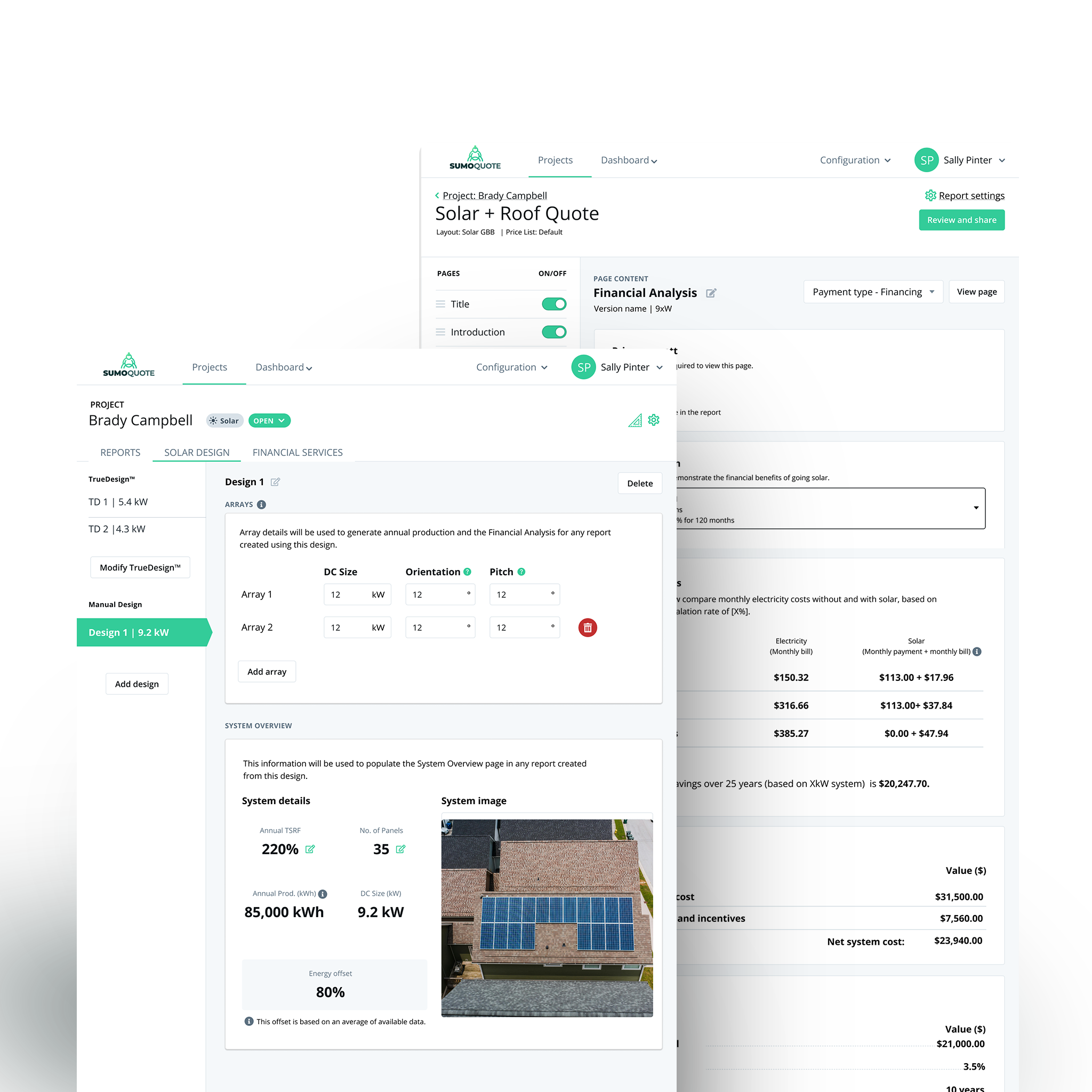

Fig 1. An early solar proposal creation flow.

The solar industry’s highly technical and policy-driven nature results in a steep learning curve. At SumoQuote, we faced the additional challenges of lacking in-house industry expertise as well as customer input.

I addressed these challenges by:

Establishing a regular touchpoint with an influential SME - a residential solar expert and board member of the Solar Energies Industry Association who could validate assumptions and review task flows

Meeting bi-weekly meeting with a Solar + Roofing customer who provided a critical user perspective and reviewed our designs

Why Solar?

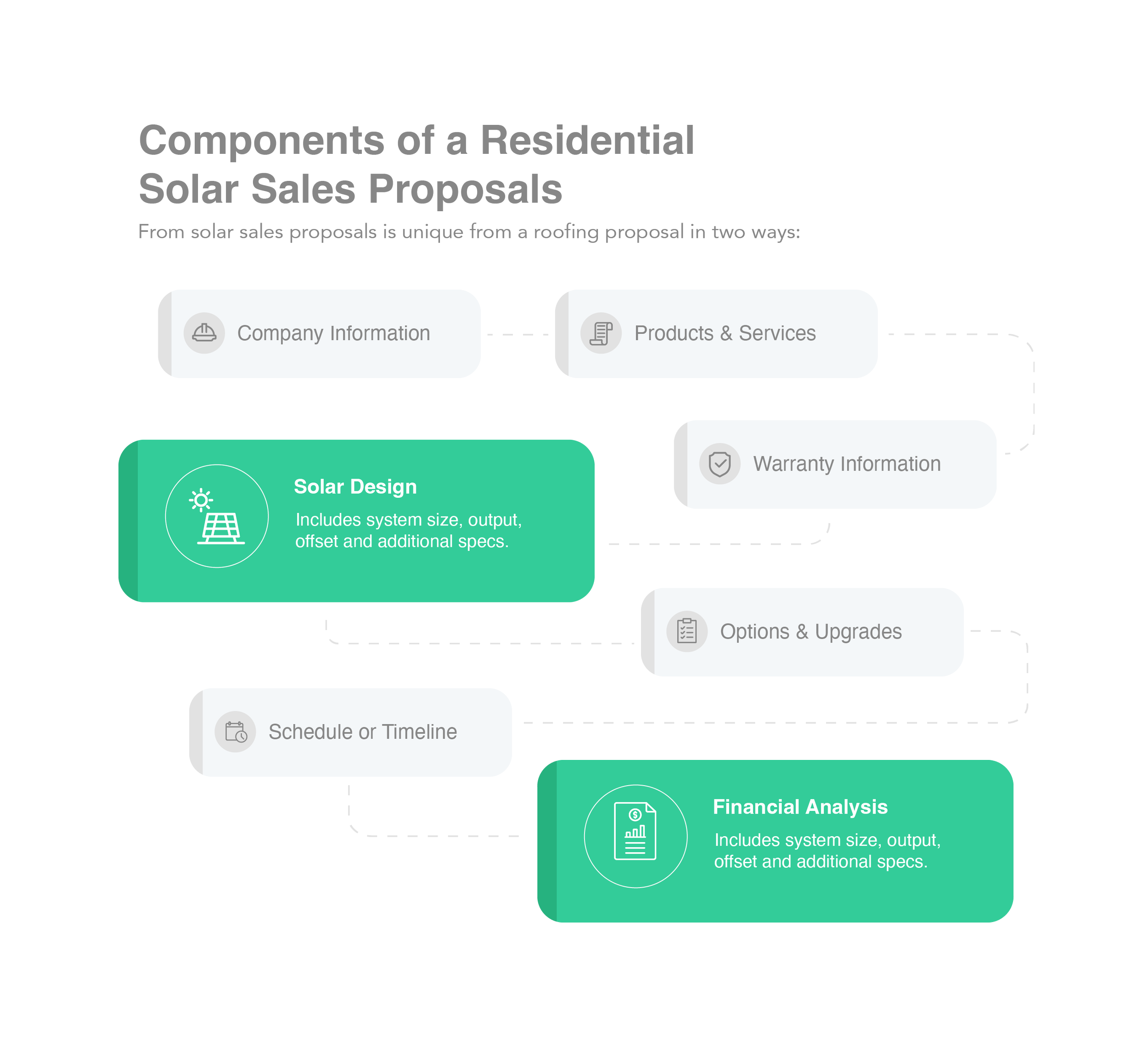

While SumoQuote’s primary use case is residential roofing, solar sales represented a significant opportunity because:

Roofers are uniquely positioned for solar sales since they are already on the roof and many solar installs require a new roof (40% of respondents of an in-app survey I created indicated they planned to start selling solar in the next year)

The most popular solar design tools (a solar design is a critical component of a solar sales proposal) have not successfully addressed a combined solar + roofing sales approach, representing an opportunity for market differentiation

An industry partner had developed a technical innovation: a best-in-class solar design tool leveraging the most accurate shade data

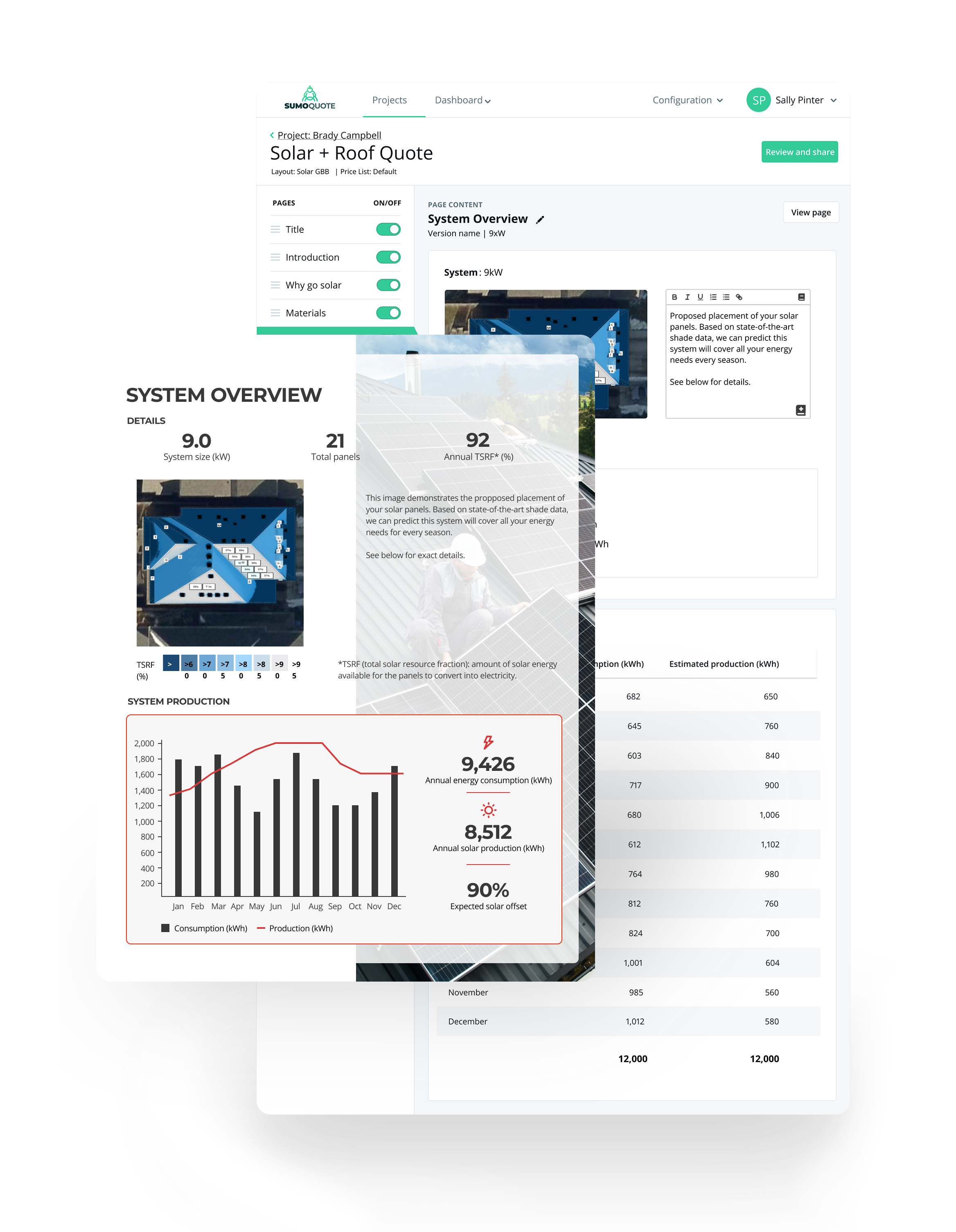

(Above) System specs as presented in a SumoQuote solar quote

(Below) Part of a financial analysis as presented in a SumoQuote solar quote

Planning A Closed Beta

Despite our best efforts to create a solar sales tool that would work for roofers, the lack of user validation was a major risk. I planned a Closed Beta program to:

expose critical usability issues

identify future roadmap items

scale up our operational readiness to support the new product

Working with a Business Development Manager, we recruited existing SumoQuote customers who also had a solar division. All of these customers were using an additional solar tool to create their solar designs and proposals.

A common theme in customer interactions was a desire to reduce the number of software solutions they used. If we could demonstrate to these customers through a closed beta that our solar offering had promise, they would happily consolidate their roofing and solar sales processes.

Risky Business (Or When It All Falls Apart)

Our Closed Beta program fell off a cliff instantly and required an intense recovery effort while exposing a major flaw in our product strategy:

The 3rd party solar design tool was unstable

a new version of the tool was published and not communicated resulting in missing webhooks and constant errors

Because we couldn’t successfully onboard our participants, engagement was at immediate risk. I worked with our development lead and our partner to migrate participants to the new version of the tool, and our BDM called them each participant personally to update them when the tool was usable again. We recovered from the setback but the risk of having our entire platform hinge on a 3rd party with questionable reliability was something we needed to address.

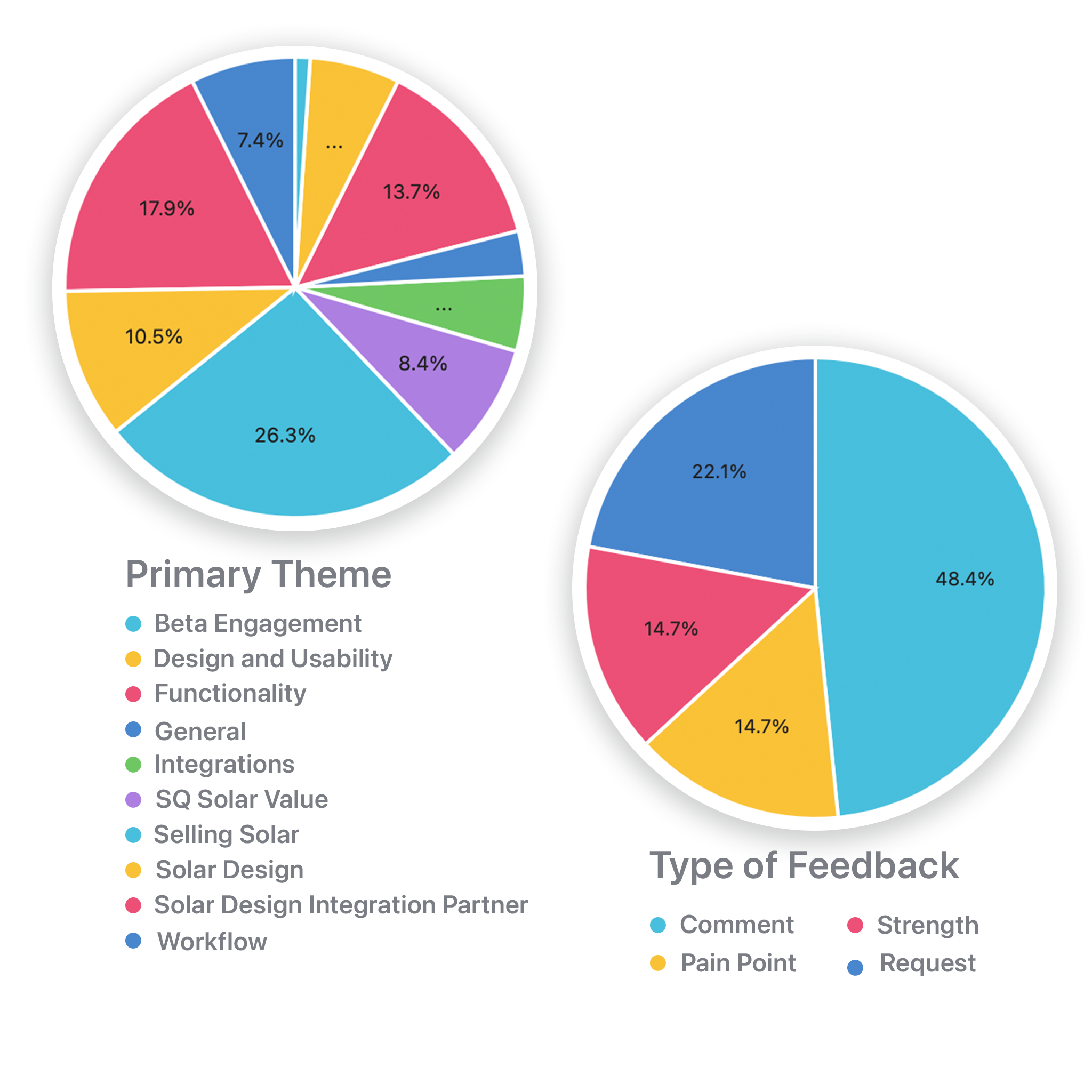

Closed Beta Gets Results

Much of the Closed Beta feedback centered around one thing: price sensitivity. Once we reached general availability, customers would pay an additional monthly fee for the solar add-on and they would incur a cost per solar design (3rd party).

Through interviews conducted by a UX researcher I had hired, we heard:

users who already had an existing solar design solution and workflow expressed that they would not be willing to take on a new cost

Some users said they would order a report (design) for a quote but if they didn’t win the work, that cost would be unrecovered

Business-savvy users wanted to offer solar as an upgrade to every roofing quote but wouldn’t want to incur the cost for the report unless the customer expressed interest in the option

This feedback solidified what we already knew: we needed a way for users to create a solar proposal that did not rely on the 3rd party.

“Be nice to have an option for contractors who don't use [3rd Party].”

“Because I have a workaround, I wouldn't want to pay additionally because the integration doesn't validate the need to pay more”

Righting The Ship

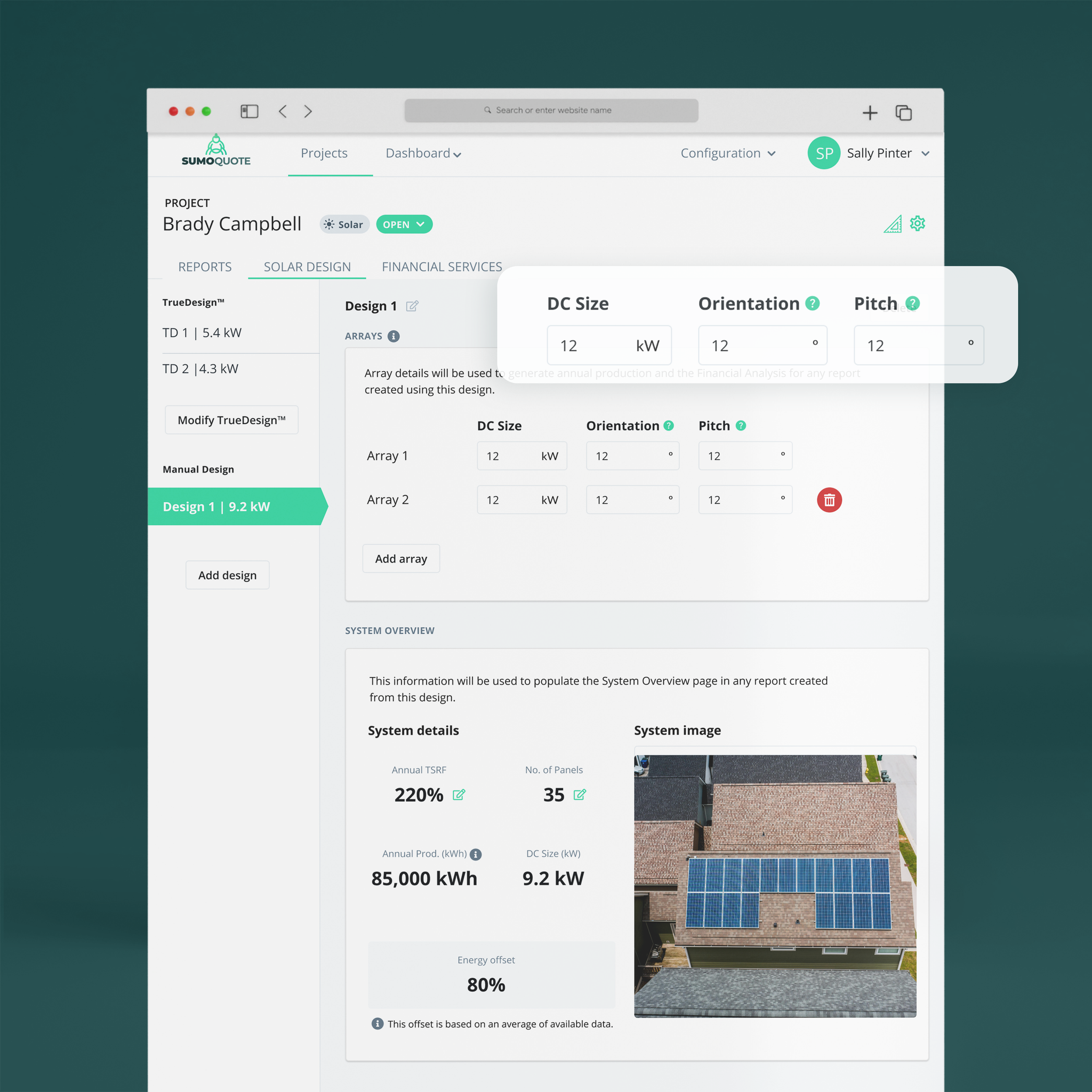

So how might we create a work-around that would enable users to still create a solar quote in a faster and cheaper fashion WHILE reducing SumoQuote’s organizational exposure?

After reviewing the dataset provided by the 3rd party design to an energy API, we realized we were only sending 3 values to generate the financial analysis: orientation, pitch and DC size.

I completed a competitive analysis to ensure that other solar design tools provide these values to users; ensuring that customers who use Aurora or Open Solar would be able to copy those values to complete a solar + roofing quote in SumoQuote

I validated my designs for a manually inputted solar design with our Customer SME; his feedback was simple: ‘When can I use this?’

We delivered this expanded scope known as “manual solar design” while we were still in Closed Beta, allowing our participants to test and further validate the approach.

KPIs & future scope…..

A critical indicator of value would be analyzing how many solar quotes are created using the ‘manual’ solution vs. how many use the 3rd party design tool (even more meaningful would be how many SOLD solar jobs used the manual solution)

if users prefer the manual version, it could mean that prioritizing integrations with other solar design tools could be a good idea

Future scope

Lessons learned